Technological developments are driving a significant change in commercial truck insurance. Why does it impact trucking business operations?

The new technologies are reshaping truck safety and influencing commercial auto insurance rates. While specifics may vary depending on numerous factors, companies that adopt trucking safety technology stand to benefit from reduced risks and lower premiums over time.

In this article, we explore how technology is altering the cost of commercial vehicle insurance. Find out how innovations such as telematics are improving safety and reducing premium rates below.

How the Trucking Industry Benefits from Technology Use

What does this technological revolution mean for the transportation sector? It signifies a shift toward safer, more cost-effective operations for trucking companies. With the use of technology, transportation businesses can significantly lower their insurance premiums and reduce the risk of truck accidents.

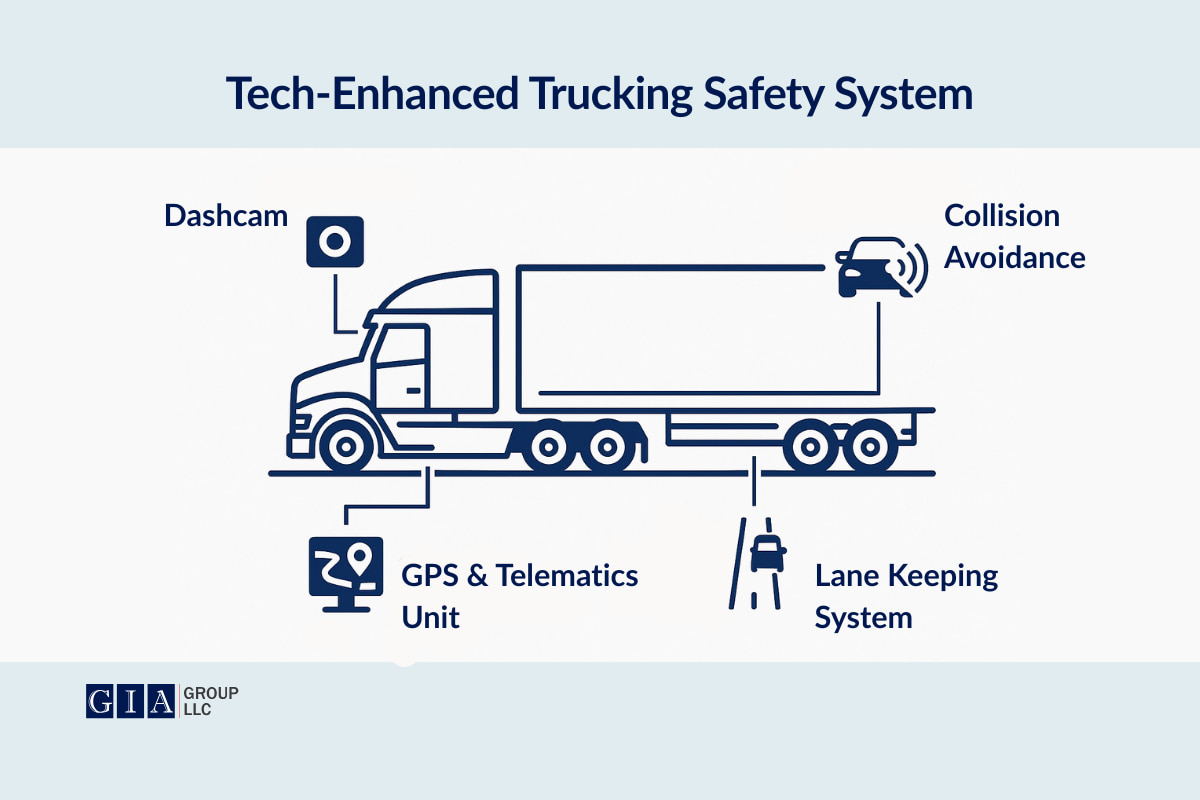

For example, trucking companies utilizing telematics, Collision Avoidance Systems (CAS), or Advanced Driver Assistance Systems (ADAS) to monitor their operations on the road have significantly lower accident rates. And lower accident rates, as we know, lead to fewer insurance claims and, subsequently, lower pay for insurance premiums. These facts point to the tremendous potential of trucking safety technology to make roads safer and bring more affordable insurance solutions for the transportation sector.

These technologies would help trucking companies enhance safety and gain financially from lowered insurance expenses. Inducing technology innovation into trucking operations for safety measures and as part of a risk management strategy creates a win-win outcome for all stakeholders.

How Technology Affects Commercial Truck Insurance Rates

As we’ve discussed, new technologies are transforming trucking insurance and, therefore, influencing the cost of commercial truck insurance. Let’s take a closer look at some of the key advancements:

Safer Trucking Operations with Telematics Technology

Telematics is one of the most impactful technologies in the commercial transportation sector. These systems gather extensive amounts of data on factors such as vehicle location, speed on the road, fuel efficiency, and driving patterns.

How does telematics impact the trucking insurance cost?

First, trucking companies using telematics to monitor their operations can address potential issues before they escalate into costly problems, such as collisions. That way, businesses can promote safer driving habits, which ultimately result in fewer accidents.

Also, by analyzing this real-time data, insurers can gain useful insights into the risks linked to individual vehicles and drivers. Depending on drivers’ professionalism and behaviors on the road, trucking companies can secure lower insurance premiums.

Advanced Driver Assistance Systems for Truckers

The spread of Advanced Driver Assistance Systems (ADAS) is another key technological advancement influencing commercial vehicle insurance rates. These include many safety features like lane departure warnings, automated emergency braking, and adaptive cruise control—all aiming to reduce the risk of accidents and improve road safety.

Insurance companies recognize the significant safety benefits of ADAS. As a result, they are more likely to offer discounts to trucking companies introducing them into their daily operations. Vehicles with ADAS are less prone to accidents and, hence, usually presuppose fewer claims and reduced insurance costs.

Proactive Collision Prevention Tools like CAS

Collision Avoidance Systems (CAS) are becoming an indispensable tool for improving road safety and, therefore, cutting insurance expenses. These systems use advanced sensors to detect potential hazards on the road and provide drivers with timely warnings. The preventative measures help avoid accidents before they occur.

Just like telematics and ADAS, CAS technology is gaining much attention among insurers. Trucking companies investing in and adopting CAS systems are often more likely to get insurance premium cuts. Overall, it reflects a growing trend where insurance providers incentives proactive safety measures by rewarding those businesses that are focused on lowering the risk of accidents.

A Safer and More Affordable Prospect for Trucking Businesses

The trucking industry is evolving. Truck insurance will reflect many improvements that are making the road safer for everyone. By injecting safety technologies into trucking operations, commercial auto insurance is becoming more cost-effective, efficient, and protective for the insureds.

Keeping your company ahead of the curve and staying current with the newest innovations transforming the sector requires constant awareness. Nowadays, being proactive in implementing trucking safety technology is essential to reducing risks on the road and improving safety. As a result, businesses benefit from lowering commercial truck insurance costs and increasing business revenue, which boosts overall business success due to the more affordable cost of trucking operations.

Protect Your Trucking Company

At GIA Group, our specialty is guiding transportation firms in finding and securing the best insurance options that meet their unique needs.

From adopting effective safety technologies to tailoring policies that protect your business, we ensure you’re well-positioned for success. Lowering insurance costs doesn’t have to be a challenge—let us show you how smart decisions and well-thought-out strategies can minimize risks and maximize your savings.

Contact us today to explore how to lower your premiums, improve your current commercial auto insurance coverage, or better understand how safety measures can impact your rates.