As a trucking or towing company operator, having the right insurance coverage is essential to protect your business from costly accidents or unexpected losses. When it comes to safeguarding the property you’re transporting or towing, tow truck insurance plays a critical role. Two important types of coverage to consider are cargo insurance and on-hook coverage, both designed to protect the vehicles or goods in your care.

Drive with peace of mind knowing help is always within reach. Through our exclusive partnership with RoadsideMASTERS.com, you get full roadside coverage including towing, tire changes, lockout assistance, and more—available 24/7 across the U.S. and Canada. Get started today!

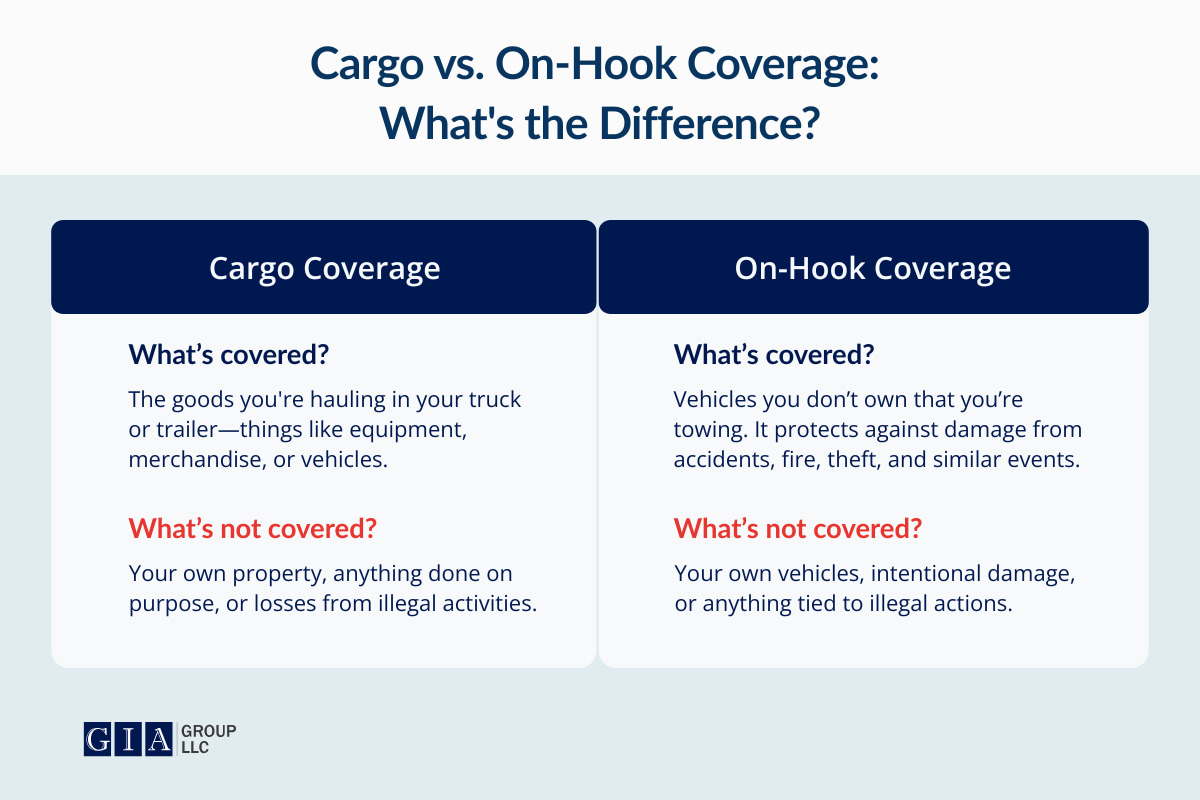

Here’s a side-by-side comparison of these two types of coverage:

Who and What is Covered?

Cargo Coverage: Protects the goods that are being transported in your truck or trailer. This can include clients’ items such as equipment, merchandise, automobiles, and other cargo.

On-Hook Coverage: Covers damage to non-owned vehicles that you’re towing. This can include damage to the vehicles caused by an accident, theft, fire, or other covered losses. On-hook coverage applies while the vehicle is being towed, transported, loaded, or unloaded.

What is Not Covered?

Both types of coverage do not cover damage to the insured’s property, intentional acts, or losses caused by illegal activities.

Examples:

Cargo Coverage: Suppose your truck is transporting a load of expensive equipment, and it is stolen while parked overnight at a truck stop. Cargo coverage would help cover the cost of replacing the stolen equipment, up to the policy limits minus the deductible.

On-Hook Coverage: Suppose your towing company is hauling a customer’s car, and it becomes damaged during transport. On-hook coverage would help pay for the repairs or replacement of the damaged vehicle, up to the policy limits minus the deductible.

Truckers and towing companies must protect against unforeseen events. For more information on what coverages you need, contact your trusted GIA agent, who is always ready to help.