As a trucking company owner or executive, understanding the nuances of trailer insurance is vital for safeguarding your assets. Trailer Interchange and Non-Owned Trailer insurance are two critical types of coverage, each with distinct features and applications.

Trailer Interchange Insurance Explained

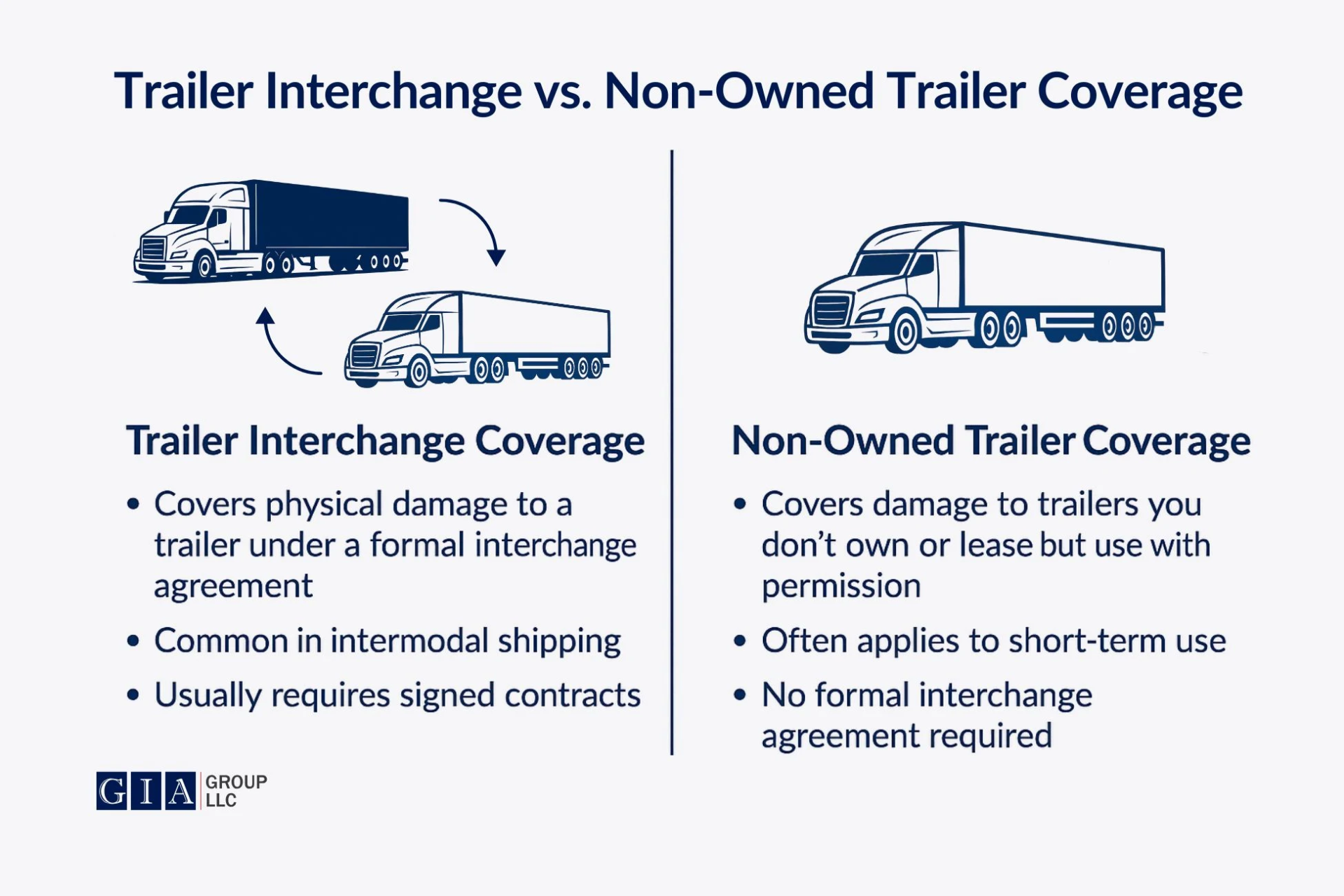

This insurance covers physical damage to trailers under your responsibility through a formal trailer interchange agreement. The coverage is comprehensive, spanning the entire duration the trailer is in your possession, whether attached to your truck or not.

Non-Owned Trailer Insurance Simplified

In contrast, Non-Owned Trailer insurance provides coverage only when the trailer is attached to your truck. It’s more straightforward than Trailer Interchange insurance as it doesn’t require a formal interchange agreement, but this also means its protection is more limited.

Key Differences at a Glance

- Coverage Scope: Trailer Interchange insurance offers broader protection, covering the entire period a trailer is under your care. Non-Owned Trailer insurance is limited to when the trailer is attached to your truck.

- Formal Agreement: A written trailer interchange agreement is mandatory for Trailer Interchange insurance, not for Non-Owned Trailer insurance.

Advising Your Insurance Agent: Setting Adequate Limits and Deductibles

An essential aspect of managing your trailer insurance effectively involves clear communication with your commercial truck insurance agents. It’s crucial to ensure that the limits set under your insurance policy align with the requirements of your interchange agreement or operational needs. The coverage limit should be sufficient to cover potential losses, and the deductible should be within the maximum allowed by the equipment owners. Failure to properly align these aspects can lead to gaps in coverage and unexpected financial liabilities.

Conclusion

Choosing between Trailer Interchange and Non-Owned Trailer insurance hinges on your specific business operations and the nature of your trailer usage. Each type offers distinct coverage benefits, and it’s imperative to make an informed decision based on your operational model. Always engage with your insurance agent to tailor your policy, ensuring it meets the coverage limits and deductible requirements for the trailers you operate. This proactive approach is key to robust asset protection in the dynamic field of trucking.